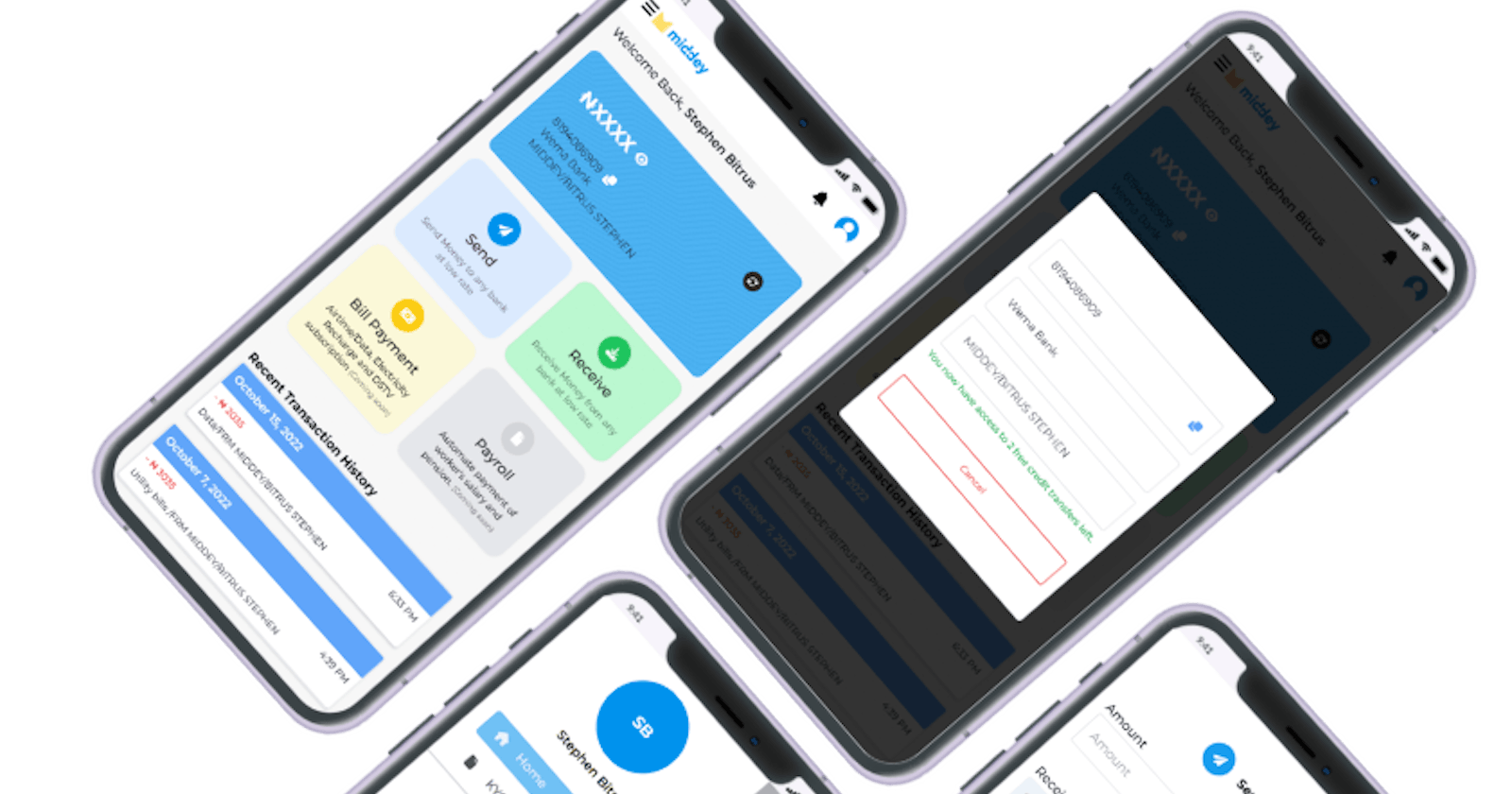

If you're struggling with making payments, paying bills, or paying workers, there's a reliable fintech application called Middey that can help make your transactions easy and seamless. Allow me to guide you through the use of this application.

Introduction

Fintech is a remarkable innovation that addresses the inconveniences associated with making transactions, such as network glitches and long queues at ATM stands. Today, businesses are leveraging new technology to make transactions more seamless and accessible.

Middey is a leading mobile banking application that offers users a simple and secure way to carry out mobile banking services. The founded John, Mfon John lunched this app on July 22, 2022, at the FCT. Middey was lunch to simplify bookkeeping and accounting tasks for small business owners and freelancers. The application allows users to manage their finances from their mobile devices, making it easy to track expenses, create invoices, and stay on top of their finances.

Features of Middey App

Middey offers a wide range of features to help users manage their finances. Some of the key features of the application include:

Expense Tracking: Middey allows users to track their business expenses by capturing receipts, categorizing expenses, and recording them in the application.

Invoicing: Users can create and send professional invoices to clients directly from the app. The app also allows users to track payments and send reminders for overdue payments.

Bill payment: If you're ever in a situation where you can't make bill payments because there is point-of-sale at your locality, or you can't get a recharge card to place a call, don't worry. With the Middey app, you can easily take care of these tasks from your device.

- Tax Preparation/Payroll: Middey can help users prepare for tax season by providing them with the necessary financial reports and information.

- Sending and receiving funds: Sending and receiving funds has also become easier with Middey. You can use the app to send money to any bank account or make transactions with your loved ones from the comfort of your home. The best part is, you can do this at a low transaction rate of just #10.

- High-level security: there is protection against second and third-party parts access to your Middey app. You can also choose to hide the amount present in your account.

How to get register on Middey

To activate Middey on your mobile device, follow these simple steps:

Step 1: Download the Middey app from the Google Play Store (for Android users) or the App Store (for iOS users).

Step 2: After installing the app, create an account by filling in your required details, such as your name, username, password, and email address. If you're already a registered member, simply sign in.

Step 3: Verify your email address by entering the six-digit code that will be sent to your email. This step is necessary to gain full access to the app.

Step 4: Complete the KYC(Know Your Customer) process by providing your bank details. This will allow you to start using the app to make transactions.

Note: By completing the registration process, you're agreeing to Middey's terms and conditions. Once you've completed these steps, you're all set to start using Middey's user-friendly mobile banking app to manage your finances and make transactions with ease.

Benefits of using Middey app

- Access to three (3) free debit transfers monthly: This means that you won't be charged for the first three times you make a transfer every month. After that, subsequent transactions for that month will be charged at a low rate. This is a great way to save money on transfer fees.

Ability to recharge your phone anytime, anywhere, and any day without having to queue.

No need to queue to receive funds from another bank, as all transactions can be carried out on the phone.

Offers all services with a low percentage rate.

With Middey, you can become a vendor and have access to selling data, recharging for your family and friends, and making money from it.

Resolves all banking service issues within a 24-hour turnaround time.

Rules and regulations of Middey App

As per the terms and conditions, by agreeing to use the service, you consent to provide your personal information and allow it to be used to enhance the quality of service provided to you.

It is important to note that by agreeing to the terms and conditions, you acknowledge and accept this condition.

Your account must be fully funded for you to be able to make any transactions.

Going over your funding limit will result in a ban from making payments.

All information provided while signing up must be accurate, including your BVN and email address.

In case of suspected fraud or unauthorized usage, contact customer care immediately for help.

Maintenance on the app may cause temporary breaks, but you will be notified.

Notifications concerning your account and its progress will be sent via push notifications, text messages, and emails. To opt out of receiving messages from Middey, unsubscribe from the mailing list or send an email to support@middey.com.

Conclusion

Middey is a comprehensive bookkeeping and accounting application designed specifically for small business owners and freelancers. Its features and benefits make it an excellent choice for those who want to simplify their finances and stay on top of their business finances. With Middey, users can save time, and money, and reduce the risk of errors, allowing them to focus on what matters most and that is growing their business.